Politics and Prescience

Since before history was written, we have looked for insight and entertainment in predicting that which we cannot know.

Technological advancements have improved the art of prediction, however, when looking into the future, some level of uncertainty will always remain.

Locked down by COVID, we become painfully aware of the power of statistics. We live our lives according to the judgement of algorithms created by unelected developers.

The modern statistics industry thrives on a constant demand for knowledge of what comes next. Gamblers, politicians, and professionals from all fields benefit from an informed analysis of future events, and a variety of methods have been developed in an attempt to provide such insight.

Despite providing the perfect environment for the use and creation of prediction markets, no decentralised prediction market platform has achieved true mainstream adoption, and all new platforms struggle to acquire a good depth of liquidity.

The first decentralised prediction market platform; Augur, took three years to launch after it’s fundraising round in 2014, and although they gained some traction during the 2018 US midterm elections, they have yet to match the volume or liquidity of their centralised counterparts.

In 2020, most political speculation trading takes place on centralised marketplaces such as FTX or PredictIt. This is an interesting real-time dashboard showing the status of PredictIt markets.

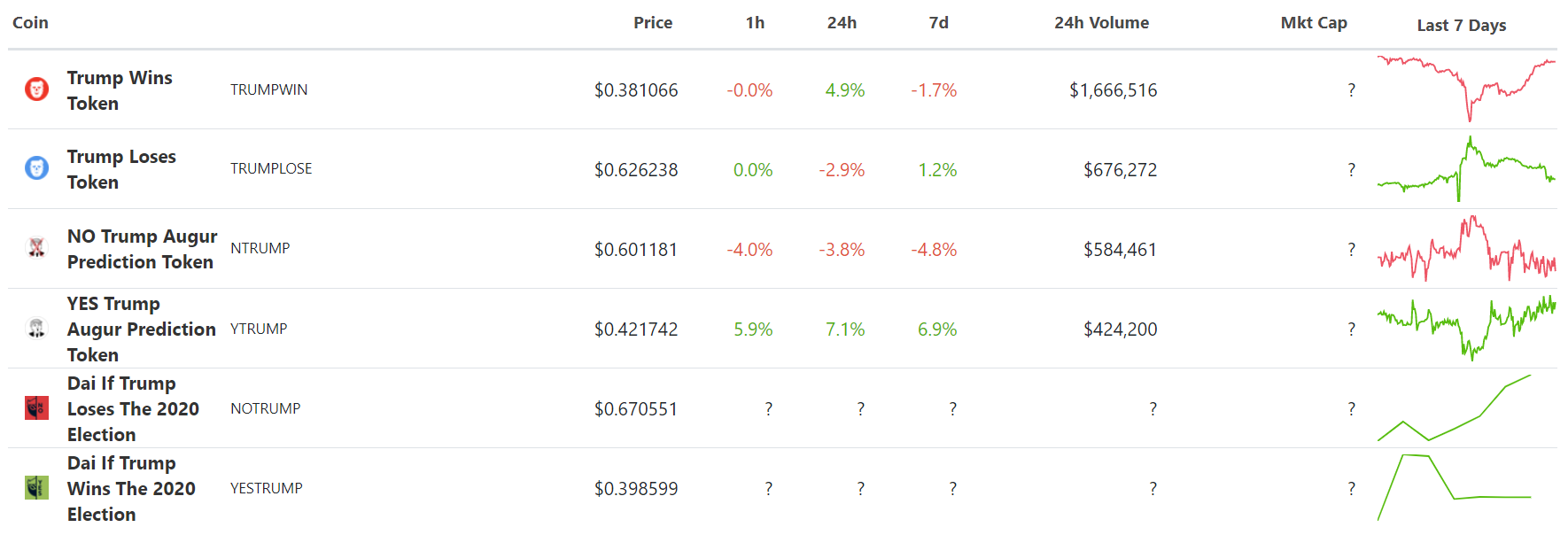

Coingecko provides a dashboard showing the top US election 2020 coins by market capitalisation.

FTX (centralised) and Polymarket (decentralised) are two crypto-based prediction markets offering odds on the results of the presidential election, which both currently put his chances of victory at around 37.8%.

Strangely, this is higher than the chances given to a Trump victory by traditional markets and statisticians, where Trump’s chances are between 4 - 14%.

There are several possible reasons for this differing prediction; Vitalik Buterin took to Twitter to express his opinions of how such a disparity could emerge.

In his "pro-prediction market" view, Buterin suggests that these novel markets

"Correctly incorporate the possibility of heightened election meddling, voter suppression, etc. affecting the outcome.” whereas traditional statistical models “just assume the voting process is fair.”

In contrast, Buterin’s “pro-statistics model” makes the following point;

"Prediction markets are difficult to access for statistical / politics experts, they're too small for hedge funds to hire those experts, and the people (esp wealthy people) with the most access to PMs are more optimistic about Trump.”

He goes on to dismiss an “unlikely” third possibility, that* “the experts" are incorrigibly dumb and just haven't learned their lessons around detecting surprise pro-Trump voters”*

After years of development, statistician Nate Silver has today ended his election forecast with the following prediction:

Joe Biden is favored to beat President Trump (though Trump still has a 1-in-10 chance); Democrats have a 3-in-4 shot at taking back the Senate; and the House will most likely remain under Democratic control (Democrats might even expand their majority by a few seats).

Are political polls less efficient than prediction markets? Markets are certainly useful for unearthing material non-public information.

Imagine an event where some people know the winner but the public does not. Once the prize gets big enough, eventually someone would bet with their inside knowledge and the market would move. (@jdh).

However, nobody knows how this election will end. There is very little inside information that can be extracted by the incentives of the market.

For now**,** it seems statisticians have the edge over the prediction market. However, they were proven wrong in 2016, and it could happen again. In the future, as prediction markets grow and blockchain technology is more widely used, the wallet of the hivemind might offer wiser insight than even our best statistician.

DeFi under Biden vs Trump

Some are of the opinion that a Biden victory would bring about greater mainstream adoption of Bitcoin, including potential approval of an ETF.

“A potential Joe Biden presidency should shine favor on further appreciation in the price of Bitcoin, in our view. New leadership may change the hands-off policy of the Trump administration — to the detriment of the broader crypto market — and nudge the firstborn benchmark toward the mainstream, improving chances for an ETF.”

However, a recent Bloomberg crypto newsletter referred to the Trump administration’s crypto policies as being “hands-off”.

Is a “hands-off” approach preferable for the industry right now?

Isolation from regulatory invaders could be beneficial for the space as our new species of financial flora and fauna grows and evolves without interference.

If an administration is good for Bitcoin, is it good for DeFi? The two sectors seem to be drifting apart, and although major players are accumulating BTC like never before, DeFi is still seen as dangerous and unexplored territory.

If prediction is the foundation of intelligence, then memories are the blocks with which it’s built. Large datasets are food for the artificial intelligentsia, who form detailed images of a future invisible to the human eye.

We are living in the information age, where data is power. Whatever the outcome of this election, during the next four years, the president elect will be forced to confront the growing demand for alternative currencies.

In a year of scarcity for the sports gambler, cryptocurrency based prediction markets have provided an accessible and entertaining event for speculation.

As volume grows, and mass adoption is achieved, these markets will provide much more than entertainment, as the conviction of gamblers and politically minded traders produces yet more data which we feed to our AI, and so the cycle continues...

Art from [https://www.artpad.org](https://www.artpad.org/) & [Things to Come - 1936](https://en.wikipedia.org/wiki/Things_to_Come#:~:text=Things%20to%20Come%20(also%20known,and%20written%20by%20H.%20G.%20Wells.)

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

Donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

Disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

You might also like...

Ape Tax

Throughout history, man has sought to distance himself from the ape. Four billion years have passed since we first emerged from the primordial soup, and now a new evolution has begun.

The Great Flash Loan

Flash loans, for better or worse, have incentivized a melting pot of talented coders of all manner of ethical fluidness to seek out untold fortunes. The concept of Flash Loan Arbing is not a sin and should never be held in such regard.

Hopium Diaries - Dystopian Dreams

The fire is growing, and a new financial world is emerging. Follow our anonymous author into the future of finance.